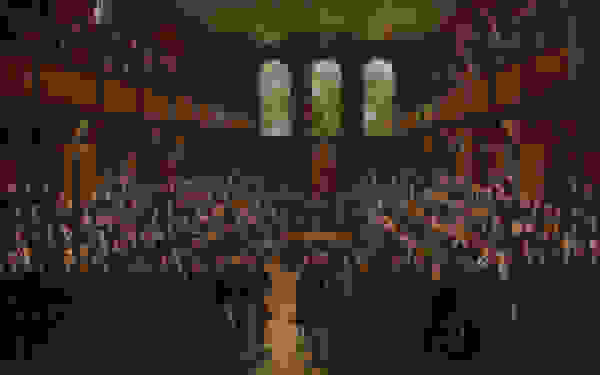

News / Parliament Matters Bulletin: What’s coming up in Parliament this week? 9-12 February 2026

MPs will debate annual increases to the state pension and a range of social security benefits, alongside proposed funding settlements for policing and local government. The Government will also lead a debate on the UK–India Free Trade Agreement. Ministers from the Home Office, Energy, Transport, and Northern Ireland departments will face oral questions in the Commons, while select committees will question ministers on business rates, housing affordability and Government data security. In the House of Lords, Peers will continue scrutiny of the Children’s Wellbeing Bill, the English Devolution Bill, and the Victims and Courts Bill. Meanwhile, Commons public bill committees will examine the Railways Bill and the Cyber Security Bill. Backbench business includes debates marking LGBT+ History Month, improving mobile connectivity, and increasing survival rates for brain tumours.